Refractory Material Market Size, Share & Trends Analysis Report 2026- 2035

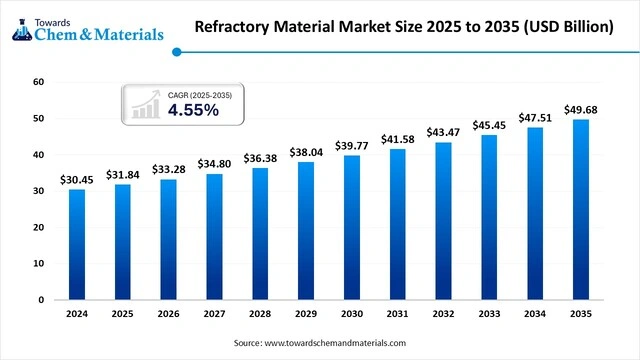

According to Towards Chemical and Materials Consulting, the global refractory material market size was valued at USD 31.84 billion in 2025 and is projected to reach USD 49.68 billion by 2035, growing at a CAGR of 4.55% from 2026 to 2035.

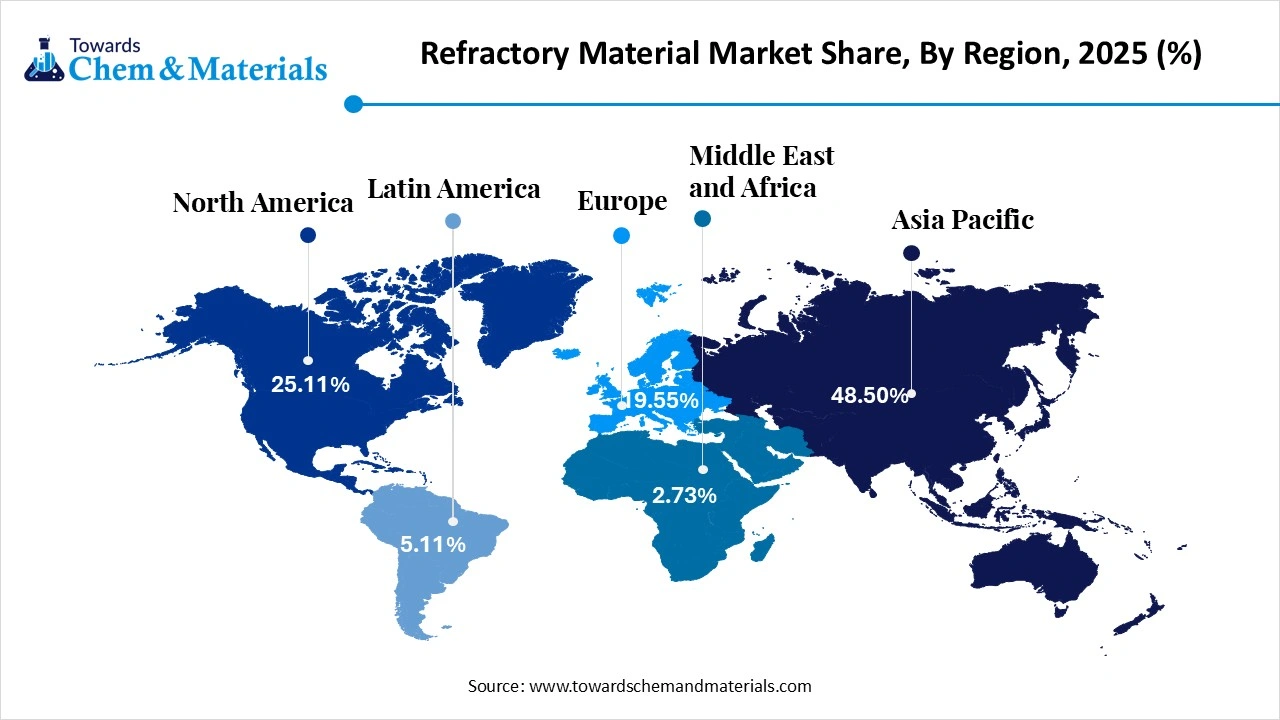

Ottawa, Nov. 28, 2025 (GLOBE NEWSWIRE) -- The global refractory material market size was valued at USD 31.84 billion in 2025, the market is projected to grow from USD 33.28 billion in 2026 to USD 49.68 billion by 2035 at a CAGR of 4.55 % during the forecast period. Asia Pacific dominated the Refractory Material market with a market share of 48.50% in 2025. The refractory material market is primarily driven by rising demand from high-temperature industrial processes across steel, cement, glass, nonferrous metals, and petrochemicals, all of which rely on refractory linings to withstand extreme heat, corrosion, and mechanical stress. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/6019

What is Refractory Material?

The refractory material market is experiencing steady growth as global industrialization, infrastructure expansion, and rising metal production fuel demand for materials capable of withstanding extreme temperatures and harsh operating environments. Steelmaking remains the largest end-use sector, supported by increasing use of EAF and DRI technologies that require frequent refractory replacement. Cement, glass, petrochemical, and power-generation industries also contribute significantly as they upgrade to more energy-efficient and high-capacity furnaces.

Innovations in monolithic refractories, high-purity ceramics, and eco-friendly formulations are reshaping the market, driven by the need for longer lining life, reduced downtime, and improved thermal performance.

Request Research Report Built Around Your Goals: sales@towardschemandmaterials.com

Refractory Material Market Report Highlights

- The global refractory material market was valued at USD 31.84 billion in 2025.

- The is estimated to reach around USD 33.28 billion in 2026.

- The market is projected to grow to approximately USD 49.68 billion by 2035.

- This reflects a compound annual growth rate (CAGR) of about 4.55% during 2026-2035.

- Key refractory material top Company RHI Magnesita (Austria), Vesuvius (UK), Krosaki HarimaCorporation (Japan),Imerys (France), Shinagawa Refractories Co., Ltd. (Japan), Saint-Gobain (France), Calderys (France)

- North America dominated the refractory material industry, accounting for the largest revenue share of 48.50% in 2025.

- By form, the shaped refractories segment led the market and accounted for 64.50% of the global revenue share in 2025.

- By material type, the alumina refractories segment accounted for the largest revenue share of 32.40% in 2025.

- By end use, the iron and steel segment dominated with the largest revenue share of 34.40% in 2025.

- By manufacturing process, the dry press process segment dominated the market and accounted for the largest revenue share of 45.60% in 2025.

- By end-use industry, the construction segment accounted for the largest market revenue share of 48.50% in 2025.

What Are The Types of Refractory Materials in The Industry?

Refractory materials come in various forms to suit different industrial needs. Some common types of refractory based on their chemical composition, include:

1. Fireclay Refractories : Made primarily of clay minerals, these are versatile and can withstand moderate temperatures.

2. Silica Refractories : Composed of pure silica, silica refractories excel in resisting acidic environments. This type of refractory can handle extreme heat changes, resist melting substances and slag, and is very durable. They are commonly used in the iron and steel industry for furnace construction.

3. Magnesia Refractories : Comprising magnesium oxide, these are ideal for high-temperature applications, particularly in the steel industry. They can withstand lime and iron-rich slags well, are tough against wear and corrosion, and remain highly heat-resistant when under pressure.

4. Chrome-Magnesia Refractories : Combining chrome and magnesia properties, these offer durability and resistance to corrosive materials. These refractories can withstand very high heat and are quite resilient in harsh, corrosive surroundings.

5. Carbon Refractories : Made from carbonaceous materials, they are suitable for extreme temperatures and chemical resistance. Primarily composed of carbon, these refractories are frequently employed in extremely low-oxygen settings. Their high heat resistance provides exceptional thermal stability and resistance to melting substances.

5. Monolithic Refractories

Monolithic refractories are specialized materials used in high-temperature applications. Unlike traditional bricks or shapes, they come as a single, unified structure and can be easily installed. These materials are commonly used to line furnaces, kilns, and other industrial equipment to withstand extreme heat and harsh conditions.

Monolithic refractories offer several advantages over traditional refractory materials. They are easier to install, as they come in a ready-to-use form, reducing both installation time and labor costs. Additionally, monolithic refractories can be customized to fit specific shapes, reducing the number of joints and seams in the lining, which can weaken it.

The customization of monolithic refractories enhances their performance. They also provide improved thermal efficiency due to their continuous structure, resulting in better energy efficiency and reduced heat loss. Furthermore, they often exhibit better resistance to thermal shock, making them suitable for applications with rapid temperature changes.

How Are The Applications of Refractory Materials in The Industries?

Refractory materials find widespread use across various industries:

1. Refineries & Petrochemical Industry : In the petrochemical sector, refractories line cracking units and reactors used in the production of various chemicals and fuels. Refractory materials are essential as they line the hot equipment used for processes like oil refining and chemical reactions, protecting them from extreme heat and harsh chemicals.

2. Power Plants : In power plants, refractories line boilers and furnaces where fuel burns to produce electricity. These linings endure intense heat, helping maintain stable temperatures for efficient energy generation.

3. Chemical Plants : Refractory materials play a vital role in chemical plants where high-temperature chemical reactions occur. They line vessels and reactors, shielding them from corrosive chemicals and maintaining the required heat for reactions.

4. Cement Plants : In cement manufacturing, refractories line kilns that operate at very high temperatures to make clinker. These materials ensure the durability of the kiln lining and efficient cement production.

5. Aluminium and Steel Industries : In steelmaking, refractories line furnaces and ladles used to melt and refine steel. Their ability to withstand high temperatures and chemical reactions is crucial for equipment integrity.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6019

Refractory Material Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 33.28 Billion |

| Revenue forecast in 2035 | USD 49.68 Billion |

| Growth rate | CAGR of 4.55% from 2026 to 2035 |

| Base year for estimation | 2025 |

| Historical data | 2021 - 2025 |

| Forecast period | 2025 - 2035 |

| Quantitative Units | Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2035 |

| Report coverage | Volume forecast, revenue forecast, competitive landscape, growth factors, and trends |

| Segments covered | By Form, By Material Type , By End-Use Industry , By Manufacturing Process , By Regional |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; Mexico; Germany; France; Russia; UK; China; India; Japan; South Korea; Brazil; South Africa |

| Key companies profiled | Calderys, Dalmia Bharat Refractory, IFGL Refractories Ltd., Krosaki Harima Corporation, Lanexis, Morgan Advanced Materials, RHI Magnesita GmbH, Saint Gobain, SHINAGAWA REFRACTORIES CO., LTD., Vitcas |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Classification of Refractory Materials

Refractory materials are classified according to various criteria, adapting to the specifications of each industrial process:

- Presentation: Divided into shaped materials (bricks and preformed pieces) and unshaped materials (concretes, insulating ceramic fibers).

- Purpose: Classified as dense, for direct exposure to industrial processes, and insulating, which help retain heat within systems to reduce energy consumption and protect metal structures.

- Chemical composition: Includes silica, silica-alumina, magnesia systems, with additions of silicon carbide, zirconium, and special combinations providing specific properties for different types of chemical and thermal attacks.

- Chemical behavior: Indicates the reactive behavior of the material (acidic, neutral, or basic), depending on the materials it may interact with at high temperatures.

-

Chemical nature: Most refractory materials are oxide-based, and research into new materials focuses on increasing their thermal and resistance capabilities.

Government Initiatives for the Refractory Material Industry

- Production Linked Incentive (PLI) Scheme The government is in consultation to include refractories in the second iteration of the PLI scheme for specialty steel, offering financial incentives to boost domestic production and reduce reliance on imports.

- National Steel Policy This policy aims to double the country's steel production capacity to 300 million metric tons by 2030, which in turn significantly drives demand for the essential refractory materials used in steel manufacturing.

- "Make in India" Initiative This program promotes India as a manufacturing hub, encouraging domestic refractory producers to expand operations, innovate, and meet global standards of quality and self-sufficiency.

- Infrastructure Expansion & PM Gati Shakti Large-scale government investments in infrastructure, such as the ₹11.21 lakh crore allocation in the 2025-26 budget and the PM Gati Shakti National Master Plan, directly increase the demand for steel and cement, the largest consumers of refractory products.

-

Improved Ease of Doing Business The government's efforts to simplify procedures, rationalize legal provisions, and digitize processes help create a more favorable and efficient environment for refractory manufacturers to operate and attract investment.

Key Trends of the Refractory Material Market

- Growing emphasis on sustainability and energy efficiency: The industry is shifting toward developing eco-friendly, low-carbon, and recyclable refractory materials to meet stringent environmental regulations and reduce energy consumption. This focus helps industries lower their carbon footprint and align with global sustainability objectives, creating a more responsible industrial ecosystem.

- Increased adoption of monolithic (unshaped) refractories: Monolithic refractories are gaining popularity over traditional bricks because they offer design flexibility, faster installation times, and create seamless, joint-free linings. This results in lower maintenance costs, better thermal efficiency, and improved resistance to chemical attack and thermal shock in high-temperature applications.

-

Integration of advanced digital technologies and automation: Manufacturers are incorporating AI, robotics, and smart sensors into production processes to enhance product consistency, optimize operations, and predict maintenance needs. These technologies also enable real-time monitoring of refractory wear conditions, improving operational reliability and extending equipment lifespans.

Market Opportunity

Heatproof Horizons: The Rising Demand for Refractory Materials

The global refractory materials market is witnessing robust growth, fueled by expanding industrialization and increasing high-temperature production processes across steel, cement, glass, and petrochemical industries. Steel production, particularly through EAF and DRI routes, remains the primary driver, requiring durable refractory linings capable of withstanding extreme heat and chemical corrosion. Simultaneously, rising infrastructure development and modernization of manufacturing facilities are boosting demand for advanced and energy-efficient refractory solutions. Innovations in monolithic refractories, high-purity ceramics, and eco-friendly formulations are enhancing durability, thermal performance, and operational efficiency.

Firing Up Innovation: How AI is Revolutionizing the Refractory Materials Industry

Artificial intelligence is transforming the refractory materials industry by optimizing manufacturing processes, improving quality control, and enhancing product performance. AI-powered predictive analytics help manufacturers anticipate wear and failure in high-temperature linings, reducing downtime in steel, cement, and glass production. Machine learning algorithms optimize raw material selection, mixing, and firing processes to increase durability and thermal efficiency. Advanced AI-driven supply chain management enables precise demand forecasting, inventory optimization, and timely delivery of critical refractory products.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6019

Refractory Material Market Segmentation Insights

Form Insights

The shaped refractories segment dominated the market in 2025 due to its precise, pre-formed shapes that offer superior mechanical strength, dimensional accuracy, and ease of installation in high-temperature industrial applications. These products, such as bricks, blocks, and tiles, are widely used in steel, cement, glass, and nonferrous metal industries, where durability and resistance to thermal shock, corrosion, and slag are critical. Rising global steel production, particularly via electric arc furnace (EAF) and direct reduced iron (DRI) routes, further boosted demand for shaped refractories in furnace linings and ladles.

The unshaped refractories segment is growing fastest over the forecast period due to its versatility, ease of installation, and ability to form customized linings for complex industrial equipment. These castable and monolithic refractories are widely used in steel, cement, glass, and nonferrous metal industries, where they provide excellent thermal shock resistance, chemical stability, and mechanical strength. Rising demand from electric arc furnace (EAF) and direct reduced iron (DRI) steel production further fueled adoption, as unshaped refractories allow faster repairs and reduced downtime.

Material Type Insights

The alumina refractories segment led the market in 2025 due to its exceptional thermal stability, chemical resistance, and mechanical strength, making it ideal for high-temperature industrial applications. It was widely used in steel, cement, glass, and nonferrous metal industries, where durability and resistance to slag, corrosion, and thermal shock are critical. Rising demand from electric arc furnace (EAF) and direct reduced iron (DRI) steel production further fueled consumption, as alumina refractories enhance furnace efficiency and service life.

The magnesia refractories segment is projected to grow fastest over the forecast period due to its excellent resistance to basic slags, high melting point, and superior thermal and mechanical stability, making it ideal for steelmaking and other high-temperature industrial processes. It was extensively used in electric arc furnaces (EAF), ladles, and converter linings in steel plants, where durability and chemical resistance are critical. Rising global steel production, particularly through EAF and DRI routes, significantly increased demand for magnesia-based refractories.

End-use Insights

In 2025, the iron and steel segment led the market due to the sector’s high-temperature processes and continuous expansion, which require durable and heat-resistant refractory linings. Steel production, particularly through electric arc furnace (EAF) and direct reduced iron (DRI) technologies, demands large volumes of refractories for furnaces, ladles, and kilns. Rapid growth in global construction, automotive, and industrial machinery industries further increased steel output, driving refractory consumption. The need for longer service life, improved thermal efficiency, and reduced maintenance costs in steel plants also boosted demand for advanced refractory solutions.

The cement segment is growing fastest over the forecast period due to the high-temperature processes involved in cement kiln operations, which require durable and thermally stable refractory linings. Rapid global infrastructure development and urbanization increased cement production, driving consistent demand for refractories in rotary kilns, preheaters, and calciners. Cement manufacturers prioritized advanced refractory solutions to improve energy efficiency, reduce maintenance costs, and extend service life under harsh thermal and chemical conditions.

Manufacturing Process Insights

The dry press process segment dominated the market in 2025 due to its ability to produce high-density, uniform, and high-strength shapes suitable for demanding industrial applications. This process is particularly favored for manufacturing bricks, blocks, and complex geometries used in steel, cement, and glass industries, where durability and thermal resistance are critical. Its high precision and repeatability allow for consistent product quality, reducing waste and enhancing operational efficiency.

The fused cast process segment is the second-largest segment, leading the market due to its ability to produce ultra-high-density, chemically stable, and thermally resistant refractory products ideal for extreme industrial conditions. This process is particularly suitable for applications in steelmaking, cement kilns, and glass furnaces, where resistance to slag corrosion, thermal shock, and mechanical wear is critical. Fused cast refractories offer superior performance and longer service life compared to conventional products, reducing maintenance and replacement costs for end users.

➤ Contact Us: sales@towardschemandmaterials.com | ☎ +1 804 441 9344

Regional Insights

Asia-Pacific Ignites Growth: Leading the Global Refractory Materials Market

The Asia Pacific refractory material market size was estimated at USD 15.44 billion in 2025 and is projected to reach USD 24.12 billion by 2035, expanding at a CAGR of 4.57% from 2026 to 2035.

Asia-Pacific dominates the market in 2025, driven by rapid industrialization, booming steel production, and large-scale infrastructure development across China, India, Japan, and South Korea. The region’s steel industry, particularly EAF and DRI-based production, is a major consumer of high-performance refractories, boosting demand for durable and heat-resistant materials. Growing cement, glass, and nonferrous metal sectors further fuel consumption, while government-backed industrial expansion and urbanization projects amplify market growth.

India Refractory Materials Market Trends

India’s market in 2025 is witnessing strong growth, driven primarily by the country’s expanding steel, cement, and glass industries. Rising demand from EAF- and DRI-based steel production, coupled with rapid infrastructure development and industrialization, is fueling consumption of high-performance, heat-resistant refractories. Government initiatives supporting “Make in India” and modernization of manufacturing facilities are promoting adoption of advanced and energy-efficient refractory solutions.

North America on Fire: Fastest-Growing Refractory Materials Market

North America is experiencing the fastest growth in the market in 2025, driven by modernization and expansion of steel, cement, glass, and petrochemical industries across the U.S. and Canada. Increasing adoption of electric arc furnace (EAF) and direct reduced iron (DRI) steelmaking technologies is fueling demand for high-performance, durable refractory linings. Investments in industrial automation, energy-efficient kilns, and advanced manufacturing processes further accelerate the use of innovative refractory solutions.

Canada Refractory Materials Market Trends

Canada’s market in 2025 is witnessing steady growth, driven by rising demand from the steel, cement, and glass industries. Expansion and modernization of EAF- and DRI-based steel production facilities are increasing the need for durable, high-performance refractories. The country’s focus on sustainable industrial practices and energy-efficient manufacturing processes is further encouraging the adoption of advanced refractory solutions. Additionally, ongoing infrastructure development and industrial projects across manufacturing and energy sectors are boosting consumption.

More Insights in Towards Chemical and Materials:

Mycelium-Based Building Materials Market Size to Hit USD 3.81 Bn by 2035

Cork Building Materials Market Size to Hit USD 20.82 Bn by 2035

Aerospace and Defense Materials Market Size to Surpass USD 49.07 Bn by 2035

Advanced Composite Materials Market Size to Surpass USD 102.15 Bn by 2035

U.S. Nanomaterials Market Size to Worth Around USD 14.41 Bn by 2034

U.S. Nanomaterials Market Size to Worth Around USD 14.41 Bn by 2034

Sustainable Materials Market Size to Hit USD 1078.35 Bn by 2034

Low-Carbon Construction Material Market Size to Hit USD 601.63 Bn by 2034

Asia Pacific Battery Raw Materials Market Size to Hit USD 93.11 Bn by 2034

U.S. Metamaterials Market Size to Surge USD 4,996.74 Million by 2034

Building & Construction Materials Market Size to Reach USD 3.90 Trillion by 2034

Building Materials Market Size to Reach USD 2.17 Trillion by 2034

U.S. Biomaterials Market Size to Surge USD 272.18 Billion by 2034

Electronic Materials And Chemicals Market Size to Surge USD 136.03 Bn by 2034

U.S. Recycled Plastics in Green Building Materials Market Size and Share 2034

Energy Dense Materials Market Size to Reach USD 211.44 Bn by 2034

Aluminum Composite Materials Market Size to Reach USD 8.18 Billion by 2034

Recycled Plastics In Green Building Materials Market Size to Reach USD 12.24 Bn by 2034

Biobased Insulation Material Market Size to Reach USD 119.34 Bn by 2034

High-Temperature Insulation Materials Market size to Reach USD 16.09 Bn by 2034

Asia Pacific Green Materials Market Volume to Reach 205.45 Million Tons by 2034

Europe Green Building Materials Market Volume to Reach 406.7 Million Tons by 2034

Biomaterials Market Size to Surge USD 526.63 Billion by 2034

Biomaterials Market Size to Surge USD 526.63 Billion by 2034

Green Building Materials Market Volume to Reach 1,271.6 Million Tons by 2034

Polymer Denture Material Market Size to Hit USD 4.11 Billion by 2034

Recent Developments

- In October 2025, Trunnano introduced ceramic products made from Silicon Nitride-Silicon Carbide. Also, this material has high temperature stability and superior thermal shock resistance, as per the report published by the company recently.

Top Companies in the Refractory Material Market & Their Offerings

- Calderys: Provides diverse shaped/unshaped refractories and technical services for global steel, foundry, and cement industries.

- Dalmia Bharat Refractory: Offers high-performance refractories and solutions primarily for iron and steel production.

- IFGL Refractories Ltd.: Specializes in manufacturing niche refractories and operating systems primarily for the iron and steel industry worldwide.

- Krosaki Harima Corporation: Provides comprehensive refractories and "Total Refractory Management" services, focusing heavily on iron and steel applications.

- Lanexis: Offers innovative, specialized refractory solutions and services for various high-temperature industrial applications.

- Morgan Advanced Materials: Specializes in highly engineered thermal management products, including insulating and dense refractories and ceramic fibers.

- RHI Magnesita GmbH: A global leader providing the most comprehensive portfolio of magnesia and alumina-based refractories for heavy industries like steel, cement, and glass.

- Saint Gobain: Provides high-performance ceramic and refractory products, focusing on advanced, sustainable solutions for the glass, ceramics, and chemical industries.

- SHINAGAWA REFRACTORIES CO., LTD.: Focuses on manufacturing and supplying various refractory materials and strategic partnerships tailored for the iron and steel industry.

- Vitcas: Offers a range of heat-resistant and refractory materials suitable for both domestic and light industrial use, such as ovens, kilns, and fireplaces.

Refractory Material Market Top Key Companies:

- Calderys

- Dalmia Bharat Refractory

- IFGL Refractories Ltd.

- Krosaki Harima Corporation

- Lanexis

- Morgan Advanced Materials

- RHI Magnesita GmbH

- Saint Gobain

- SHINAGAWA REFRACTORIES CO., LTD.

- Vitcas

Refractory Material Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Refractory Material Market

By Form

- Shaped Refractories

- Unshaped (Monolithic) Refractories

By Material Type

- Alumina Refractories

- Silica Refractories

- Magnesia Refractories

- Zirconia Refractories

- Carbon Refractories

- Others (Chromite, Fireclay, etc.)

By End-Use Industry

- Iron & Steel

- Cement

- Glass

- Non-Ferrous Metals

- Power Generation

- Petrochemical

- Ceramics

By Manufacturing Process

- Dry Press Process

- Fused Cast Process

- Hand Molded Process

- Formed Process

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6019

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.